New Credit Card Rules- Heads Up! Your Favorite Credit Cards Are Changing Their Rules!

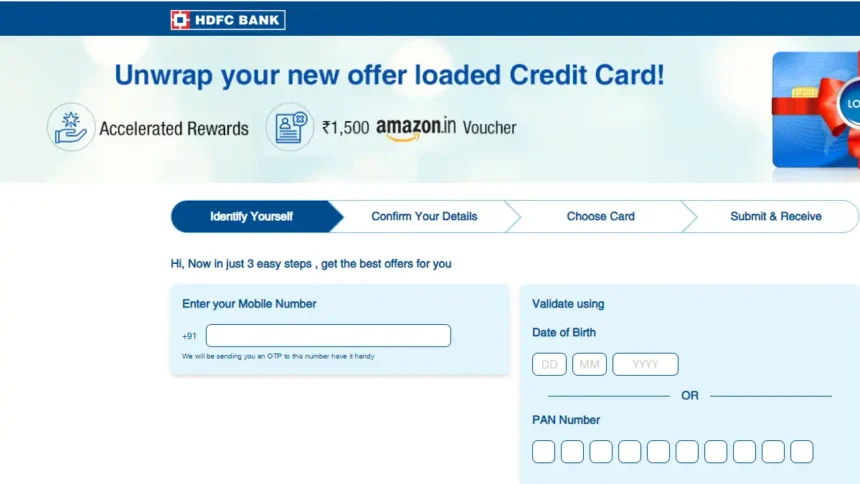

New Credit Card Rules- Hey there, swipers and spenders! Big news about your plastic pals – major banks like SBI Card, HDFC Bank, ICICI Bank, and Axis Bank are revamping the rules and rewards for some of their popular credit cards. Let’s see what’s cooking:

Lounge Lizards, Pay Attention!

- HDFC Bank Regalia & Millennia: Lounge access isn’t free anymore! Spend at least Rs. 1 lakh each quarter to earn 2 (Regalia) or 1 (Millennia) voucher for complimentary visits. You can find them on the “Regalia SmartBuy” or “Millennia Milestone” pages after December 1st.

Cashback Crunch Time:

- SBI Card Paytm: Don’t expect sweet cashback for paying rent using your Paytm SBI Card anymore. This perk bites the dust on January 1st, 2024.

Reward Point Shuffle:

- SBI Card SimplyCLICK/SimplyCLICK Advantage: EazyDiner online orders won’t fetch you 10X reward points anymore. But hey, you still get 10X for Apollo 24×7, BookMyShow, and others!

Axis Bank Tightens the Belt:

- Axis Bank Magnus: This card’s benefits are shrinking. Say goodbye to the hefty joining bonus and hello to a higher annual fee. Check out the new terms before your next swipe!

- Axis Bank Reserve: Similar story here – benefits downgraded, terms revised. Time to brush up on the new rules.

ICICI Bank Revamps Rewards & Lounges:

- Airport Lounge Access: Get ready to spend! From April 1st, 2024, you’ll need to shell out Rs. 35,000 each quarter to score one free lounge visit.

- Reward Points: Brace yourself for changes to reward points rules on many ICICI Bank cards. Stay tuned for updates!

Remember: These are just some highlights. Always double-check the official sources for the complete picture. Don’t let these changes catch you by surprise – stay informed and keep swiping smart! We also shared details on how to enable domestic transaction on ICICI bank credit card, do check out that.

The Advantages of Wielding the Credit Card Power

Credit cards aren’t just for emergencies or indulgences; they come with numerous perks that can simplify your life and offer financial advantages. Here are some key benefits:

- Convenience: Say farewell to carrying a wad of cash. With a credit card, a simple swipe or tap is all it takes to make a purchase. No more searching for exact change or worrying about losing your hard-earned money.

- Build Credit: Responsible use of a credit card can significantly boost your credit score, paving the way for lower interest rates on loans, mortgages, and insurance. Consider your card as a credit-building tool, not just a spending instrument.

- Rewards Galore: Many credit cards feature rewards programs that earn you points, miles, or cashback on your everyday purchases. These rewards can be redeemed for travel, merchandise, gift cards, or even statement credits. Who doesn’t love free stuff?

- Purchase Protection: Most credit cards provide purchase protection, insuring you against theft, damage, or loss of eligible items purchased with your card. Shop confidently knowing your valuable purchases are safeguarded.

- Fraud Protection: Credit cards offer enhanced fraud protection compared to debit cards. If your card is lost or stolen, you’re typically not liable for unauthorized charges, providing an extra layer of security and peace of mind.

- Travel Perks: Many travel-focused credit cards offer benefits such as airport lounge access, travel insurance, and car rental discounts, enhancing the enjoyment and convenience of your trips.

Finding Your Perfect Plastic Match

With a multitude of credit cards available, making the right choice can be challenging. Fear not, budget warriors! Here are some tips to guide you:

- Consider Your Spending Habits: Choose a card that rewards the categories you spend the most on, be it groceries, gas, or travel.

- Look for a Good Introductory Offer: Many cards entice with sign-up bonuses or introductory interest rates. However, factor in the annual fee and long-term interest rate before deciding.

- Read the Fine Print: Avoid surprises by carefully reviewing the card’s terms and conditions before applying.

- Compare and Contrast: Utilize online comparison tools to see how different cards stack up against each other. Choose the one that offers the best value for your money and aligns with your spending habits.

Responsible Credit Card Use is Key

Remember, credit cards are a potent tool that, when used responsibly, can bring numerous benefits while avoiding pitfalls. Practice responsible credit card use by:

- Paying Your Balance in Full and On Time: Avoid interest charges and late fees by paying your statement balance in full each month.

- Living Within Your Means: Don’t overspend just because you have a credit card. Only charge what you can afford to pay back.

- Monitoring Your Spending: Keep track of your credit card expenses to stay aware of your spending habits and prevent overspending.

By using your credit card wisely, you can enjoy its many benefits and navigate your financial journey with confidence. So, dive into the exciting world of credit cards and find the perfect plastic partner to empower your financial endeavors!

Credit Card FAQs: Your Guide to Navigating the Rules

Q: What is the new rule by RBI for credit card?

Credit card companies are changing the rules to make customer get the best experience major change has come in lounge access, now it will given according to spending base.

Q: What are the new rules for credit card bill payment?

A: Auto debit mandate is now being revoked due to some guidelines from RBI India. Check your credit issuer more more details.

Q: What is the Supreme Court Judgement on credit card defaulters?

A: In September 2022, the Supreme Court clarified that banks cannot arrest defaulters based solely on non-payment of credit card dues. However, defaulting on your credit card can have severe financial consequences, including:

- High interest charges and late fees

- Damage to your credit score

- Difficulty obtaining loans and credit cards in the future

- Legal action by the bank to recover the debt

Q: Can I be jailed for credit card debt in India?

A: In India, you cannot be jailed for mere non-payment of credit card dues. However, if you are found guilty of criminal intent or fraud related to your credit card, you could face legal consequences, including imprisonment. Always avoid intentional misuse of your credit card.

Q: What is the legal case for non-payment of credit card?

A: Non-payment of credit card dues is a civil matter, not a criminal one. Banks can initiate legal proceedings against you to recover the outstanding debt, including filing a lawsuit and attaching your assets. It’s advisable to communicate with your bank and explore repayment options if you face payment difficulties.

Q: What happens after a credit card legal notice?

A: Receiving a legal notice from your bank regarding unpaid credit card dues is a serious matter. It’s crucial to respond promptly and discuss a repayment plan with the bank. Ignoring the notice can lead to further legal action, including court proceedings and attachment of assets.

Q: What happens if I don’t pay my credit card for 5 years?

Avoiding credit card payments for an extended period can have severe consequences. It can lead to:

- Accumulation of high interest and late fees

- A significantly damaged credit score

- Difficulty obtaining loans and credit cards in the future

- Legal action by the bank for debt recovery

- Potential damage to your financial reputation

Q: What happens if a credit card is not paid for 3 months?

Missing credit card payments for even 3 months can have negative consequences:

- Late payment charges will be applied

- Your credit score might suffer, impacting your future borrowing ability

- The bank might restrict your credit limit or even freeze your card

- Ignoring the issue can lead to further escalation and legal action

Remember, communication and responsible credit card use are key to avoiding these consequences. If you’re facing payment difficulties, contact your bank and explore options to manage your debt and get back on track.