How to enable Domestic Online Transaction in ICICI Credit Card

How to enable Domestic Online Transaction in ICICI Credit Card?- ICICI Bank, a pioneering name in the financial landscape, offers a multitude of services tailored to the evolving needs of its customers. One such vital service is enabling domestic online transactions through their credit cards. In this comprehensive guide, we delve into the intricate process of activating and utilizing ICICI credit cards for seamless online transactions within India.

Understanding ICICI Credit Cards and Online Transactions

Types of ICICI Credit Cards

ICICI Bank offers an array of credit cards, each designed to cater to diverse financial requirements and lifestyles. From premium travel cards to cashback and rewards-based options, the spectrum of ICICI credit cards ensures there’s a card suited for everyone.

Enabling Domestic Online Transactions

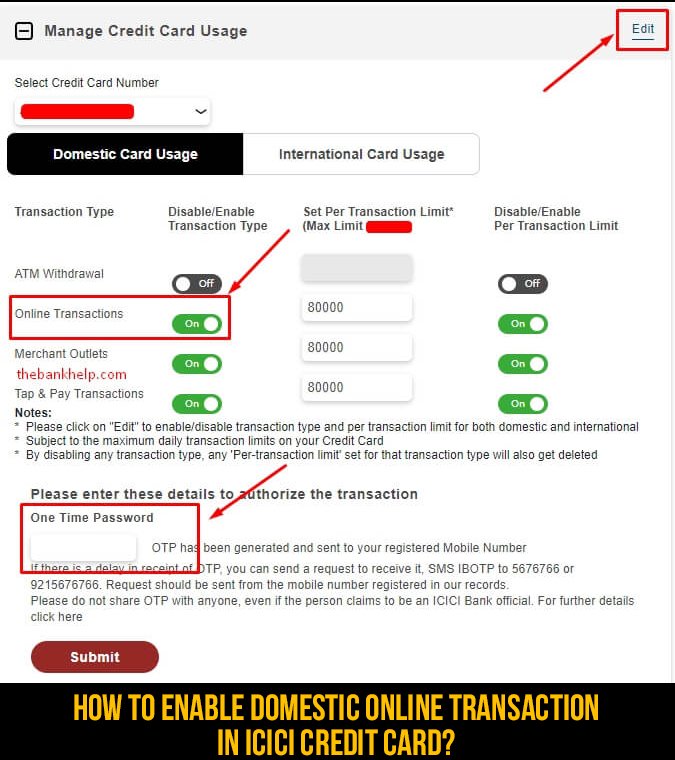

Step-by-Step Guide to Enable Online Transactions

- Login to your ICICI Net Banking Account: Access your account through the official ICICI website or mobile app.

- Navigate to Credit Card Section: Locate and click on the ‘Credit Cards’ tab.

- Select the Desired Credit Card: If you possess multiple cards, choose the specific one you want to enable for online transactions.

- Click on ‘Manage Card’: This option will lead you to a menu where you can manage various aspects of your card.

- Activate Online Transactions: Look for the ‘Enable/Disable Online Transactions’ tab and select ‘Enable.’

- Set Transaction Limit (if applicable): Some cards allow users to set limits for online transactions for added security. Adjust this as per your preference.

- Confirm and Authenticate: Follow the prompts to confirm the activation. This might involve OTP verification or other security measures.

Benefits of Enabling Domestic Online Transactions on ICICI Credit Cards

- Convenience: Enjoy the ease of making secure transactions from the comfort of your home.

- Enhanced Security: ICICI employs robust security protocols, ensuring a safe online transaction environment.

- Reward Points and Cashback: Many ICICI credit cards offer rewards and cashback on online transactions, making it financially advantageous.

- Instant Transaction Status: Get real-time updates on your transactions, enhancing transparency and control over your spending.

Troubleshooting and Additional Tips

Troubleshooting Guide for Online Transaction Issues

- Check Internet Connectivity: Ensure stable internet connectivity before initiating transactions.

- Contact Customer Support: If facing issues, reach out to ICICI’s dedicated customer support for prompt assistance.

- Update Card Details: Regularly update your card details to avoid transaction failures.

Additional Tips for Safe Online Transactions

- Use Trusted Websites: Always transact on secure and reputable websites.

- Keep Credentials Confidential: Safeguard your card details and avoid sharing sensitive information.

Conclusion: Empowering Seamless Online Transactions

Enabling domestic online transactions on your ICICI credit card streamlines your financial transactions, offering convenience, security, and added benefits. Embrace the ease of online spending within India with ICICI Bank’s user-friendly services.

Frequently Asked Questions (FAQs)

1. How do I activate online transactions on my ICICI credit card?

To activate online transactions on your ICICI credit card, follow these steps:

- Log in to your ICICI Net Banking account.

- Navigate to the ‘Credit Cards’ section.

- Select the specific credit card you wish to enable for online transactions.

- Find the ‘Manage Card’ option and choose ‘Enable/Disable Online Transactions.’

- Follow the prompts to enable online transactions, confirming the activation via OTP or other security measures.

2. Are there any transaction limits for online purchases?

Some ICICI credit cards offer the option to set transaction limits for online purchases. Check your card’s features to see if this is available. If so, you can adjust these limits according to your preferences.

3. How long does it take for online transactions to be enabled after activation?

Typically, online transactions are enabled instantly after you confirm the activation. In some cases, it might take a few minutes for the changes to reflect. Ensure a stable internet connection and check your card’s status to verify the activation.

4. What should I do if I encounter issues while enabling online transactions?

If you face any difficulties or encounter errors while activating online transactions, it’s advisable to:

- Check your internet connectivity.

- Verify that you’ve followed the activation steps correctly.

- Contact ICICI Bank’s customer support for immediate assistance and troubleshooting.

5. Are there any security measures in place for online transactions on ICICI credit cards?

ICICI Bank implements robust security measures to ensure the safety of online transactions. These may include OTP verification, encryption protocols, and transaction monitoring systems to detect and prevent fraudulent activities.

6. Can I use my ICICI credit card for online transactions internationally?

The process for enabling international online transactions might differ from domestic transactions. To enable international online transactions, check your card’s settings or contact ICICI Bank’s customer support for guidance.

7. Are there any additional fees for enabling online transactions on my ICICI credit card?

Typically, there are no additional charges for activating online transactions on your ICICI credit card. However, specific card features and terms may vary, so it’s recommended to review your card’s terms and conditions for any associated fees.

8. How can I ensure the security of my card details during online transactions?

To ensure the security of your card details:

- Only transact on secure and reputable websites.

- Keep your card information confidential and avoid sharing it with unauthorized sources.

- Regularly update your card details and passwords for added security.

These FAQs aim to address common queries related to enabling domestic online transactions on ICICI credit cards. For further assistance or specific inquiries, feel free to contact ICICI Bank’s customer support or refer to their official website.

Hope so you might find this article “How to enable Domestic Online Transaction in ICICI Credit Card” helpful.

You may also like to read about Google Pay Loan. Click Here

Check out official ICICI Bank Credit Card Website Click Here